how to calculate a stock's price

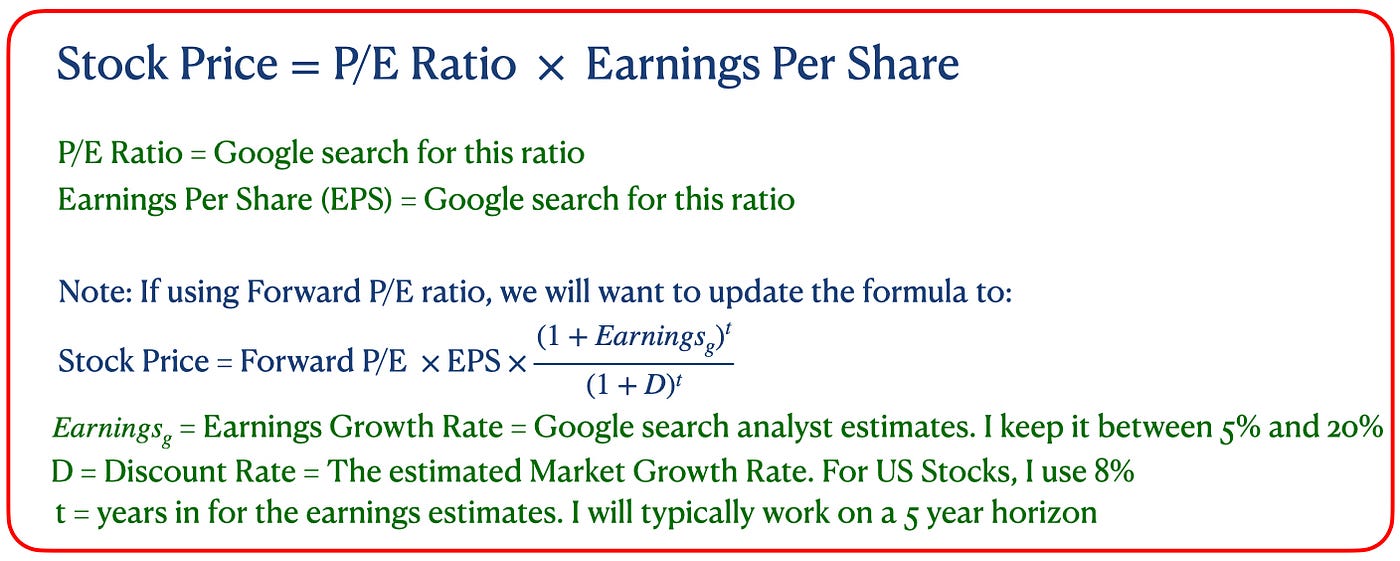

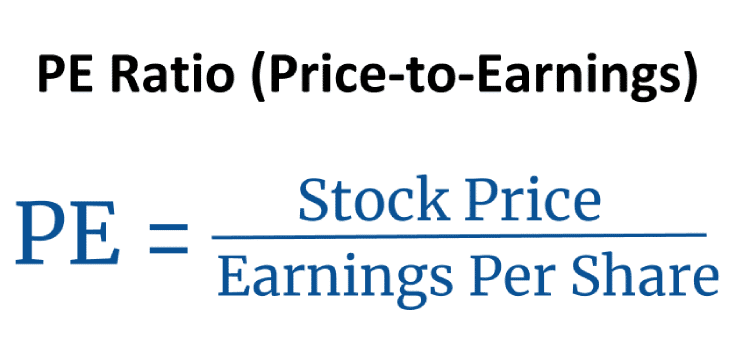

The PE ratio equals the companys stock price divided by its most recently reported earnings per. Price 817 3289 where Price is equal to 26871.

How To Calculate Future Expected Stock Price The Motley Fool

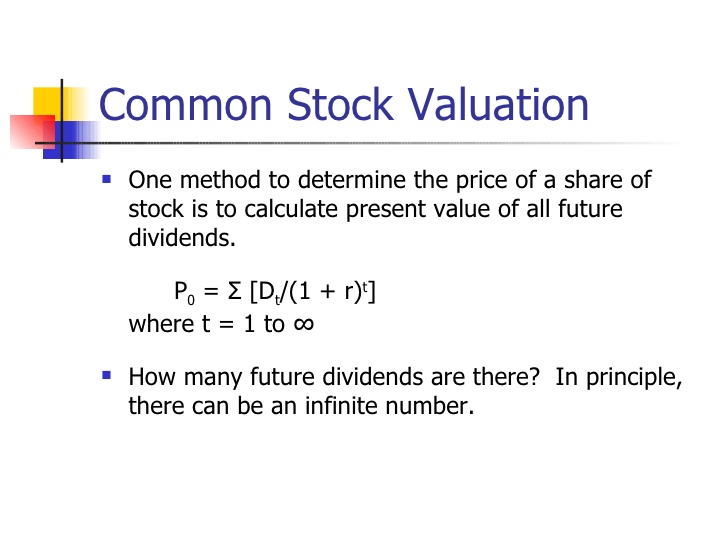

Calculating expected price only works for certain types of stocks For newly established companies with rapid growth and unpredictable earnings and dividends future stock price is anyones guess.

. For example if the FY Corporations preferred stock currently pays a 200 dividend and investors require a 10 percent rate of return on preferred stocks of similar risk the preferred stocks present value is the following. If it were trading at its historical PE ratio of 18 the current stock price. The lower the PE ratio the better and the lower the ratio compared to related companies the better.

Calculate the firms stock price book value from the balance sheet. The most common way to value a stock is to compute the companys price-to-earnings PE ratio. Just follow the 5 easy steps below.

It is calculated by looking at the stock price relative to the companys earnings and is useful when compared to similar companies in the same industry. Divide the firms total common stockholders equity by the average number of common shares outstanding. The formula to calculate the target price is.

The current PE ratio is 67 divided by 419 equals 16 times. In this case the adjusted closing price calculation will be 20 1 21. Here look for the trailing PE as of December 31st 2019.

If you buy the stock at 3 the PE ratio is 3 which is calculated by dividing the price of the stock by its earnings per share or 3 divided by 1. If the stock price goes up to 10 the new PE ratio is 10. Annual Return Simple Return 1 1 Years Held-1 Lets use Campbell Soup.

Stock price price-to-earnings ratio earnings per share. Annual Dividends per share. Since the industry PE ratio is 10 this may be telling you that the stock is no longer undervalued and its time to sell.

Shares BoughtPurchased Price nth 3. The buying price of stock typically varies every day due to the market. Book Value per Share.

For example Facebooks target price for 2020 is. The new stockholder equity amounts to. Of shares outstanding Substituting the.

Simple Return Current Price-Purchase Price Purchase Price Now that you have your simple return annualize it. We can rearrange the equation to give us a companys stock price giving us this formula to work with. For example assume you bought 10.

100000 23000 60000 193000. Therefore our capital gain is. Enter the number of shares purchased Enter the purchase price per share the selling price per share Enter the commission fees for buying and selling stocks Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional.

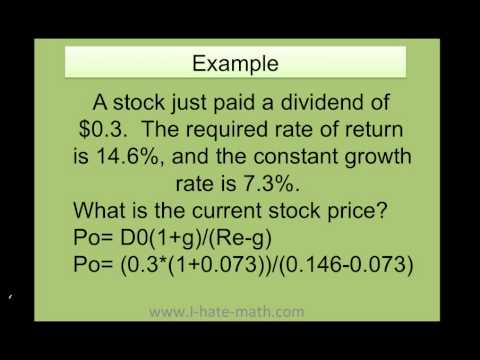

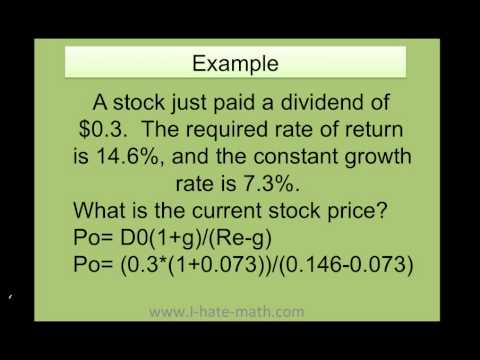

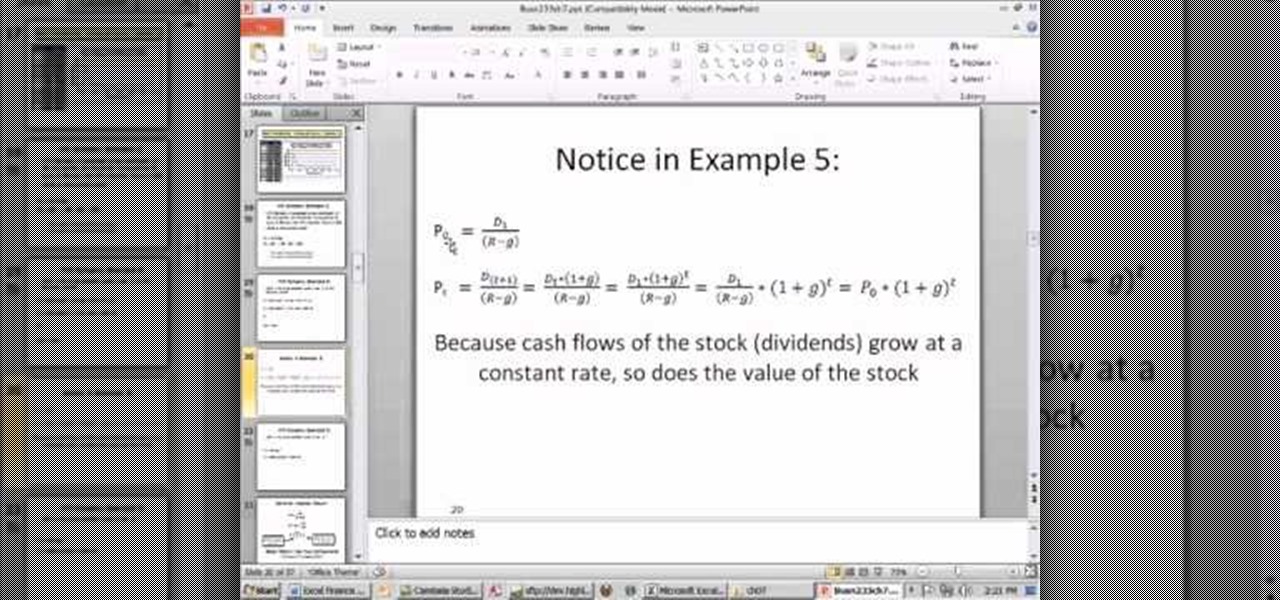

Calculating Todays Stock Prices. Finding the growth factor A 1 SGR001 Computing the future dividend value B DPS A Calculating the Estimated stock purchase price that would be acceptable C B. Price Estimated EPS Trailing PE where Price is the variable we are solving for.

Stock Average Price Total Amount Bought Total Shares Bought If you want to calculate stock profit please use the Simple Stock Calculator. The Stock Calculator is very simple to use. Arrears amount to 3000 The new formula for book value per share Stockholders Equity Preferred Stock Arrears No.

Divide the total amount invested by the total shares bought. This will give you a price of 667 rounded to the nearest penny. Sum the amount invested and shares bought columns.

How to Calculate share value Example. Stock bought at different periods in time will cost various amounts of capital. To compute the average price divide the total purchase amount by the number of shares purchased to.

200 010 2000. The first step in calculating gains or losses is to determine the cost basis of the stock which is the price paid plus any associated commissions or fees. The price of Stock A is expected to be 10500 per share in one years time P1.

Last 12-months earnings per share. Dividends are expected to be 300 per share Div. The algorithm behind this stock price calculator applies the formulas explained here.

How to Trade Stocks. Total Amount Bought Shares BoughtPurchased Price 1st Shares BoughtPurchased Price 2nd Shares BoughtPurchased Price 3rd. Price of Stock A is currently 10000 per share or P0.

For example if the firms total common stockholders equity is 63 million and the average number of common shares outstanding is 100000 then the stock prices book value for the firm would be 63. You can also figure out the average purchase price for each investment by dividing.

Intrinsic Value Formula Example How To Calculate Intrinsic Value

How To Calculate Weighted Average Price Per Share Fox Business

How To Find The Current Stock Price Youtube

Common Stock Formula Calculator Examples With Excel Template

How Do I Calculate Drift From A Series Of Stock Prices Personal Finance Money Stack Exchange

How Is A Company S Share Price Determined India Dictionary

How To Price A Stock Buy Sell Hold Go Long On A Put By Kk Karan Kumar Medium

How To Calculate Weighted Average In Stock Valuation Rakub Org Bd

The Stock Price Of Retro Co Is 65 Investors Required A 12 Percent Rate Of Return On Similar Stocks If The Company Plans To Pay Dividend Of 3 80 Next Year What Growth

How To Calculate Future Expected Stock Price The Motley Fool

How To Find The Current Stock Price Youtube

Excel Finance Class 65 Calculate Stock Price At Time T Using Dividend Growth Model Youtube

Pe Ratio Price To Earnings Definition Formula And More Stock Analysis

How To Calculate Stock Prices With The Dividend Growth Model In Microsoft Excel Microsoft Office Wonderhowto

How Is Market Price Per Share Calculated Quora

Present Value Of Stock With Constant Growth Formula With Calculator

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)